KQ Newsletter #2,March 15, 2008- Dead Cat Bouncing!

March 15, 2008

The KQ Newsletter–

Your best karma-changing resource on the web.

Issue #002, Saturday, March 15, 2008. Published Fortnightly.

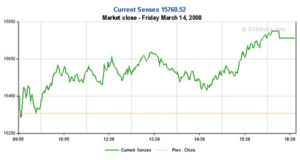

In the last fortnight a lot has happened in the stock-markets and the global economies. As predicted and expected, the BSE-30 Sensex took regular dips below 16,000, going below the January lows and hovered around 15,500.

The index bounced up again in yesterday’s closing, breaking below the January lows — going down to 15,331 before gyrating up to 15,760. But this is less of a recovery and more of a dead cat bounce–the index repeatedly drops, bounces up, drops lower than before, bounces back up but less than the previous up-moves, and continues to repeat this going lower and lower. Don’t expect great up moves from this market in the next few weeks.

Watching the business news on TV confirmed this. CNBC-TV18’s coverage on the stock markets was an uncomfortable, almost embarrassing experience. Udayan Mukherji was shell-shocked–“The markets have capitulated,” he said. “Let us pray!” While Shireen Bhan looked like she was ready to cry. Definitely a dead cat bouncing.

This was and is a great opportunity to buy stocks that have a sound business model and are now undervalued because of the panic. The same company that was good two-three months ago is fundamentally still the same. If one has money available, this is the time to buy the chosen stocks a little at a time as an investor looking at a time-frame of a year or so. The Sensex and Nifty are likely to go down further, yielding more buying opportunities.

Housewives having sold gold at near a thousand dollars an ounce, (Rs. 12,500-Rs.12,900 per 10 grams) are thinking of buying back in in small coins when the price drops–if it drops? Historically gold has been cheaper around June, July and August.

However, inflation is increasing in India; a simultaneous recession and stagflation loom in America; the world’s banking systems are in a spin. Investment banks like Citigroup, Bear Stearns and Goldman Sachs are close to collapse, due to the bad housing loans they made.

************* Update ************

(9:15 am Washington time, March 14)The US Federal Reserve has just given Bear Stearns a bailout, taking over their securities debt, invoking a law last used 40 year ago. This was done to stave off a total collapse of Bear Stearns. I expect this will spread to other securities and investment firms. Bear Stearns shares fell 47% in value on this bailout news. Bloomberg has the story here.

*********************************

Some of this is spreading to India through banks such as ICICI who have some small exposure to the US home-loan debt market. On this news of losses by ICICI, Indian bank stocks got hammered much more than they deserved this week.

Prior to this there was market nervousness about the 60,000 crores farmers loans written off by the Finance Minister and the negative impact on public sector banks. This was a smart move because in a few years the loans would have gone bad for the most part impacting the PSU banks profitability. This was a master-stroke of genius on humanitarian, political and economic grounds.

Money is still tight at home, the RBI deferring reduction of interest rates, although some banks have responded to the FM’s suggestion that banks voluntarily reduce interest rates.

“Neither a borrower nor a lender be; for loan oft loses both itself and friend, and borrowing dulls the edge of husbandry,” said Polonius in Hamlet–Shakespeare’s equivalent of a modern-day action thriller.

This is certainly true in this unfolding financial action-drama of the world. Unlike Hamlet, this one is not a thriller. It is more evidence that living beyond one’s means does not lend itself to protecting or ‘husbanding’ money. I would not at all be surprised to see credit card crunches coming up abroad. Ultimately the tax-payer and the inflated cost of living will end up bailing out the banks and people who should never have been given such magnitude of home loans in the first place. Governments will print more paper money and reduce the interest rates. Gold and silver will shoot up.

The deadly ‘ides’ (15th) of March are here–made famous by Shakespeare’s Julius Caeser where a soothsayer warned the emperor to beware the ides of March and a threat to his life. Of course Caeser disregarded this and paid for it with his life.

Well, individual tax returns (and the taxes due) are to be filed by today for individuals, otherwise there are penalties and interest payable to the government. If you have not yet filed your tax returns (if due), then take this opportunity to save money by investing in an equity linked saving scheme fund (ELSS).

A couple of useful things to remember:

Banks also keep themselves up to date on fund action so you could conveniently check with your local bank.

Special clairvoyant money-saving and growth guidance :

Does this look like your wallet–the way you keep money in it?

If it is then you are more likely to spend money on things whimsically, and somewhat wastefully.

Why? That is because the energy of the money kept this way is looking to jump out any way it can!

Compare this to the money save mode wallet and how the money is placed in a systematic way. This way, the money will remain inside your wallet and you would spend it more on useful things.

Compare this to the money save mode wallet and how the money is placed in a systematic way. This way, the money will remain inside your wallet and you would spend it more on useful things.

How does this work? Based on how I see the energies moving for saving and expenditure, the method given here keeps the money energies within the wallet space. The money likes the way it is kept and wants to stay longer in your wallet–lucky you! This permits money to go out of your wallet more and more for useful and essential expenditure, while curtailing waste.

The method:

As you do this, your wallet will go into money-save mode. Save the money, put it in your Saturday Box (or make your own) and multiply your savings.

Insurance schemes are being advertised as a saving scheme and even as pension schemes that get you tax benefits. Known as ‘ULIPS’ or unit linked insurance plans that invest in equity and other money market instruments, these are a hustle. As March 31 approaches, more insurance agents are after your money– sometimes advising the innocent and gullible that ULIPs are a great saving/investment instrument with safety of insurance. Some misrepresent ULIPS to be better than the ELSS.

The short and simple on ULIPs? You lose because these funds are not open and transparent about how they manage and invest the money. In a number of cases it has been publicly revealed in the press that the ULIP fund house allocated as much as 72% of the amount paid in the first installment as agent’s commissions, reducing the value to the subscriber substantially.

Insurance is never an ‘investment’. If you have life-cover insurance needs take a pure Term policy. These have the lowest premiums and there is no money-back or endowment business. If you take the balance of the premium you would save by not taking the ULIP or other such policy, and put it into a mutual fund with a good track record, you will earn many times more this way. Avoid money-sucking ULIP vampires.

There’s a lot of good work for you here to change your financial and opportunities karma–do let me know how these work out for you. I would also like to get your feedback on what more you would like to see in “KQ”.

Until next fortnight–

Be with the KQ Force!

Nalin K. Nirula

Copyright (c)2008-2014 by getting-positive-karma-now.com, . Thank you for your interest in “KQ”. We do not allow republication of our full newsletters and articles. However, you can post a portion (no more than 90 words, 1-2 paragraphs) of our content with a live link back to our homepage (www.getting-positive-karma-now.com), or a link to the specific article you are quoting from.

THE SMALL PRINT:

DISCLAIMER: We encourage all visitors to use the information here and on our website as a resource only to further their own research. The information on and through this site is for informational and educational purposes only. Finance related information: Nothing published on this site should be considered as financial advice. You should consult a financial adviser prior to making any actual investment or trading decisions. These works are based on current events, SEBI, NSE and BSE filings and releases by other bodies corporate in India and abroad, press releases, interviews and what we’ve learned as karmic and financial journalists. The works may contain errors and you should not make any investment decision based solely on what you read here. It’s your money and your responsibility. Other information: Nothing in this Newsletter or on the website should be considered as financial, medical, legal or other advice. You should consult health, legal and other appropriate professionals and advisers before taking any decisions in these areas.